As the need for clean energy grows and uranium oversupply diminishes, demand for the energy fuel is likely to grow. Investing while uranium stock prices have room improvement could offer an opportunity. Futures are an important part of the market as there is currently no exchange-listed, transparent price instrument that consumers and suppliers can use to manage prices and risks. Furthermore, uranium futures provide investors with a marketplace for direct exposure to the price of uranium. As a third option, investors can look to the futures market while awaiting a rise in the uranium price. Futures are financial contracts that obligate the buyer to purchase (or the seller to sell) an asset like a physical commodity or financial instrument at a predetermined future date and price.

Buy 130 Shares of This Dirt-Cheap Uranium Stock for $16,719 in Potential Returns – Yahoo Canada Finance

Buy 130 Shares of This Dirt-Cheap Uranium Stock for $16,719 in Potential Returns.

Posted: Tue, 05 Sep 2023 07:00:00 GMT [source]

Exchange-traded funds that invest in baskets of uranium- and nuclear-related companies provide a convenient way to acquire a diversified uranium portfolio. The world’s pursuit of reducing emissions and reaching targets has revived the controversial power source. Meanwhile, developments in miniaturized nuclear reactors and nuclear fusion technology have done their part to put the power source on the watch lists of many governments worldwide. The rising urgency to save our planet, along with the discontinuation of coal and natural gas (a fossil fuel), are key catalysts.

Uranium Market Heads for Potential Shortage, Says Nuclear Association

With an average concentration in the Earth’s crust of 2.8 parts per million, uranium is a sought-after commodity. There are about 4 hedge funds tied up in the company investing a total worth of $6 million. Apart from uranium, the company also has interests in iron ore, copper, diamonds, gold, and uranium, among other metals. The company also has everything from underground mines, mills, refineries, smelters, power stations, and research and service establishments. It really is one of the largest mining companies in the world in terms of market capitalization. By the end of the first quarter of this year, there are currently 7 hedge funds investing in the company at a total value of $12.3 million.

Nuclear, by contrast, is cheap, reliable, and works in all weather conditions. Born in Maine and Living just outside of New York City, Jenna holds an MBA in Finance from the University of Maryland and has been actively trading stocks for nearly 11 years. The most notable of their projects is the Rook 1 Project that consists of 32 contiguous mineral claims over 35,065 hectares located in the Athabasca Basin of Saskatchewan region.

Zacks Mobile App

The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines. NexGen completed a feasibility study on Rook I in 2021, and the project is currently in development with the advancement of front-end engineering design (FEED). In the first quarter, Denison commenced an in-situ recovery field test program at Wheeler River’s high-grade Phoenix deposit. https://1investing.in/ The results will inform a feasibility study for the project slated for completion in Q4 of this year. On the date of publication, Faisal Humayun did not hold (either directly or indirectly) any positions in any of the securities mentioned in this article. On the date of publication, Josh Enomoto did not have (either directly or indirectly) any positions in the securities mentioned in this article.

It also recently announced the discovery of more high-grade uranium at McClean Lake South. This company does not currently have any active mines but is working on developing two in Saskatchewan. Right now, rare earth metals are in high demand for new technologies like electric cars. In addition to uranium, Energy Fuels is a large producer of vanadium and other rare earth metals. It is based in Canada and trades on both the New York and Toronto stock exchanges.

Is Uranium a Good Long-term Investment?

Consider also that the firm is the second-largest producer of uranium in the world — accounting for 18% of the global production. Another one of our very companies, NexGen Energy has only been around since 2011. That being said, the company has provided 222% returns on investments in the past 12 months. In the short time of the company’s existence, the operations have expanded to exploration, development, and acquisition of uranium-related projects. Of course, these large mining companies are not the last word in the market. In fact, there are quite a few mid-tier and junior uranium exploration companies that investors may want to discover.

Access to a wide variety of metals usually bodes well for share price even though things are in a decline at present. BHP Group is a well-diversified mining operation based on the Australian continent. This will increase its potential yield once the mine is up and running.

Rio Tinto Group (NYSE: RIO)

Uranium Energy Corp. is a mining and exploration company based in the U.S. It has projects in Texas, Wyoming, Paraguay, New Mexico, Colorado, Arizona and Canada. Faisal Humayun is a senior research analyst with 12 years of industry experience in the field of credit research, equity research and financial modelling. Faisal has authored over 1,500 stock specific articles with focus on the technology, energy and commodities sector.

The company also believes that it has some of the best undeveloped uranium projects in the world. There seems to be visibility for further growth in proved reserves. According to the International Atomic Energy Agency, global nuclear generating capacity was 393 GW (net electrical) in 2020. In an optimistic case scenario, global nuclear generating capacity performance indicators examples is expected to double to 792 gigawatts by 2050. An author, teacher & investing expert with nearly two decades experience as an investment portfolio manager and chief financial officer for a real estate holding company. A former senior business analyst for Sony Electronics, Josh Enomoto has helped broker major contracts with Fortune Global 500 companies.

It’s like buying physical gold and waiting for the price of gold to appreciate. Looking at the brand’s valuation ratios, we can see an impressive demand surge over the last few quarters. Additionally, the company’s earnings per share have surged 185% this year alone. Cameco Corporation reportedly recorded 45 million pounds worth of long-term uranium contracts last year, with plans to increase that number moving forward.

This makes it a great time to look at these three undervalued nuclear power stocks to buy. Though uranium stocks have indicated the ability to increase despite unfavorable market conditions, this is by no means a guarantee of profits. This is another of those very historic companies that are more than a hundred years old. The Australian-based company was founded in 1885 and deals in a diverse range of interests in mining, with stakes in oil, gas, copper, silver, zinc, and uranium, among other resources. The Texas-based company has been dealing in the exploration and mining of uranium since its establishment in 2003. The company is Colorado-based and has been in operation since the late 1980s.

From a financial perspective, Uranium Energy has a healthy balance sheet with $120 million in liquid assets. With a production-ready resource base, UEC stock looks like a potential value creator. Additionally, the demand outlook for nuclear power might imply further upside in spot price. There is no commodities market for the radioactive mineral so investors who want to profit from uranium’s rise have to invest in stocks and exchange-traded funds. The recent launch of the world’s largest physical uranium exchange-traded fund (ETF), the Sprott Physical Uranium Trust Fund (SRUU.F 3.91%) has been an even bigger catalyst. The companies that have upcoming growth catalysts and operate in the uranium and minings sector were selected for the list.

One of the more profitable investments, the company has garnered investors 312% in returns in the past 12 years. Well, we have condensed in this list 10 of the best uranium stocks along with a quick profile of each company’s recent performance. Nuclear power, and uranium by extension, has earned a less than stellar reputation over the past few decades. The nuclear disasters of Chernobyl and Fukushima have undoubtedly hurt demands for uranium and the stocks of the company that mines for it. Against that backdrop, analysts at Haywood Securities recently shared the uranium stocks they are watching. Read on to learn about these companies; all stats were current as of June 13, 2022.

Do some comparison shopping to find the best broker for your needs – or to make things easier, use our comparison tool to find the best investment app. Wall Street is home to a number of analysts whose job it is to research stocks and come up with recommendations. These analysts can be helpful, but it’s unwise to take their word without doing your own research first. On the date of publication, Ian Bezek held a long position in BWXT and TRP stock. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

- Uranium stocks are just waiting to trend upward again, so now is an excellent time to add them to your portfolio.

- The company is based in Corpus Christi and currently has several properties in Texas, Arizona, Colorado, New Mexico, and Wyoming.

- There seems to be visibility for further growth in proved reserves.

- With the company featuring a forward yield of 13.7%, investors can lock themselves into one of the best uranium stocks to buy and get some serious passive income along the way.

BHP has a robust balance sheet and a market cap of US$166.74 billion. For investors, this is an opportunity to capitalize on emerging trends and make some profits in the process. In this article, we will look at the best uranium companies to invest in for 2023. We’ll discuss how you can identify a good stock, where you can find reliable information about uranium stocks, and which ones may be worth investing in over the next few years.

Why Today’s Inflation Data Could Lead to a Powerful Stock Rally

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities. As governments are realizing that nuclear is a better option, they’re approving more nuclear projects.

He then started writing about Australian and U.S. equities for various publications. His work has appeared in MarketBeat, FXStreet, Cryptoslate, Seeking Alpha, and the New Scientist magazine, among others. If this plan reaches fruition, shareholders stand to benefit considerably.

High-grade uranium is used for various use cases, including in nuclear reactors. Although the ores are more expensive to procure, they are also far easier to extract energy from than their lower-yield counterparts. They also have use in smaller-sized reactors, laboratories, naval vessels, nuclear weaponry, and other experimental fields set to expand.

In the years since, fears over the radioactive risks posed by nuclear reactors, paired with excess supply, have weighed on prices. The move in the underlying commodity has helped stocks in companies related to the industry. The Global X Uranium ETF (URA Quick QuoteURA – Free Report) has been on fire lately. With this frenzy on the move, which stocks within this industry are in the good graces of our Zacks Rank?

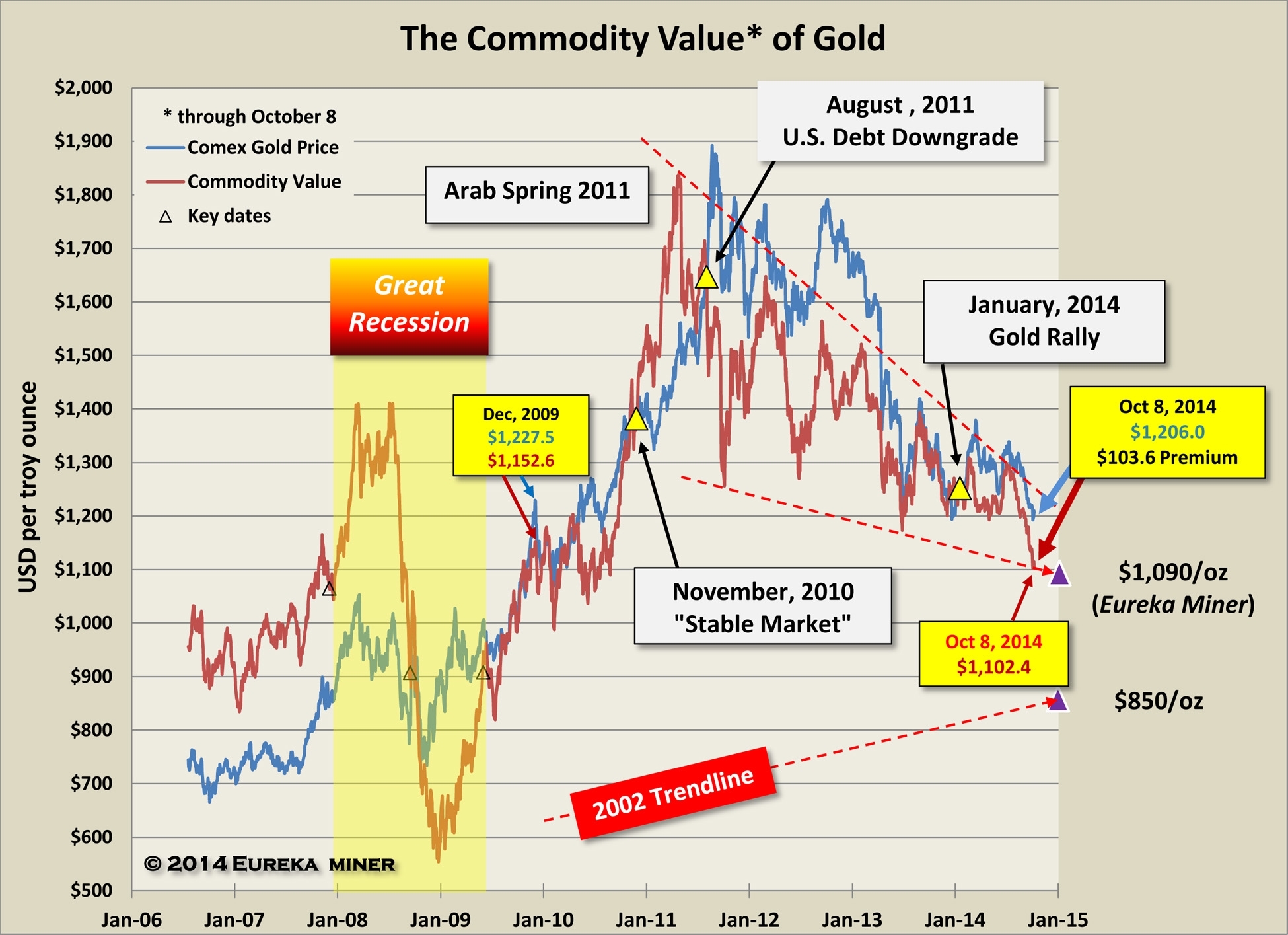

This has spurred demand for uranium to increase and, despite the ongoing concerns, uranium stocks remain as one of the best-performing commodities second only to gold. Understanding where these companies’ uranium mines and production facilities are located can help investors make informed decisions. Those interested in uranium stocks may want to look at the countries that produce the most of the metal. The three top uranium-producing countries are Kazakhstan, Namibia and Canada. That’s right folks, the commodity used to fuel nuclear power plants has surged to its highest level since 2014, and a new Cold War is not the reason for the spike.

As this project progresses, it might produce up to 6.3 million pounds of U3O8, a compound of uranium. According to the WHO, millions of people die from the air pollution caused by fossil fuels each year. Still, as energy realities of the new normal set in, it’s possible greater demand can enter the space.

Leave a Reply